Our game plan for the week was to continue to wait for the market to reveal its hand. We knew the trading was going to be choppy because of the existing momentum conflicting with the current cycle counts, so we have to be patient while price works its way through these levels…

…we have a huge POMO injection from the Fed today, and that has consistently been $SPX positive and GLD negative. However, our ideal framework continues to unfold nicely. The dollar formed a swing high today and is possibly moving into its brief cycle low. The $SPX is making another attempt at recent highs, but it should come up short and provide us instead with a nice short entry. XIV is along for the $SPX ride as usual, but could face some nasty days over the next few weeks as traders panic for the first time in 2013. GLD and GDX are experiencing weakness on the $SPX strength, but volume is much lighter and so far it is just part of the chop that comes with going against the short-term momentum:

Be patient, and don’t get shaken out of your positions or try to overtrade the chop. Our stops are in place under the Feb. 20th lows if the market throws us a curveball.

Good trading all.

Steve Chapman, TRI

Tonight will be an assortment of charts as we continue to wait patiently for the currency and equity markets to make some decisions after their violent moves yesterday. Precious metals have continued on their path of mean-reversion back to the 50 MA, but commodities in general are extremely weak with only natural gas, cotton, and soybeans above their respective 50 MA’s…

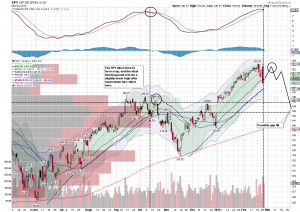

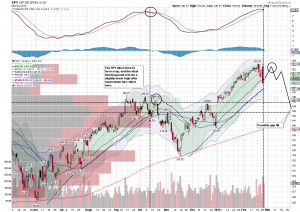

…the $SPX is slowly losing momentum, and just as the Titanic took 3 hours to sink this index will not go down easily, especially with the Fed juicing it. The longer-term MACD is getting ready to roll over, and the ideal short entry is on a bounce once the MACD has crossed over with a stop at the previous daily cycle high. We could potentially fill the gap left over from the Fiscal Cliff resolution as a target area for a cycle low. The last two cycles bottomed at the 250 MA, so that is also a potential target. Be patient when hunting an elephant as momentum does not die quickly:

Even though currencies are hopelessly broken from Central Bank intervention right now, we have to respect the move in the dollar. Traditional risk correlations are not working at the moment, but the dollar did just form a new yearly cycle by besting its previous intermediate cycle high. There is a lot of upward momentum, and a daily cycle low will probably be minimal at best because this one is becoming very right-translated. A bounce from the oversold Euro (at 57.6% of the dollar index) could be the catalyst for the cycle low. Looking ahead, we have an overhead gap and the MA Envelopes as likely targets during the next daily cycle, and if this intermediate cycle is to be left-translated then that would be a good spot for the cycle to roll over. That could also be a significant inflection point for awaking commodities once again. Do not over think currencies right now because they can flip directions in an instant, but respect them because momentum is momentum:

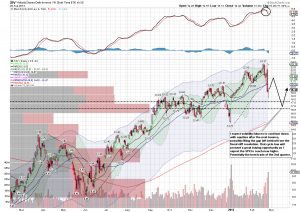

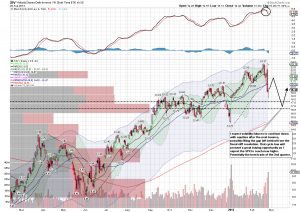

After the $VIX’s massive spike yesterday, we saw the VIX futures form a hammer today on the XIV chart. XIV is likely to follow the $SPX with a weak bounce up here before joining in its decline to a cycle low. Once again, the Fiscal Cliff gap is a likely price target, although it can overshoot it as traders get emotional on the final decline. However, the XIV low might coincide with the completion of the precious metals mean-reversion trade to their 50 MA, and has the possibility of being the best trade of the 2nd quarter if the $SPX makes it to new highs:

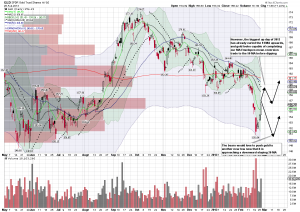

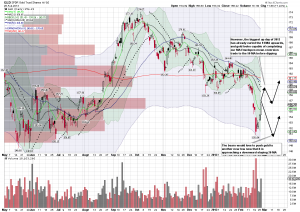

GLD had its biggest day of 2013 today, and the MA Envelopes mean-reversion trade continues to work. The move was big enough today to curl the 9 EMA upwards, and that is a small positive as it works its way back to the 50 MA. Don’t expect the shorts to give up easily at the downward 20 MA, and we also have to be aware of the bears trying to force a retest of the recent lows. We have a stop at the low of Feb. 20th, and we will regroup if new price lows are made. Open interest in the futures continues to decline, and that is a positive as price moves upwards instead of downwards as it likely means that shorts are being forced to cover:

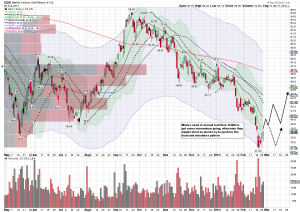

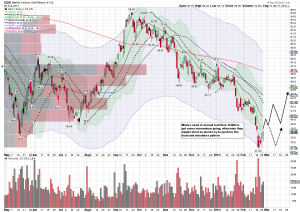

Miners did not show the same strength that GLD did today, as they failed to break the 9 EMA once again. ABX did not get through its 20 MA, and NEM is still deciding whether it wants to go up or down despite swelling volume over the past week. Some of the index components are as oversold as 2008, and it might just take shell-shocked investors a few days of GLD strength before they are willing to jump in. The massive head and shoulders pattern is also nerve wracking, but could potentially create a nice short squeeze if price can move above the 20 MA. Just like GLD, our stop is under the huge volume of the Feb. 20th low. We will regroup if the bears manage to push price under there once more:

Continue to wait patiently for these moves to develop. The SPX does not top quickly and precious metals tend to crawl out of lows and explode into tops. Patience is the name of the game for the week.

Good trading all.

Steve Chapman, TRI

On February 20th, the market gave us mean-reversion trade signals in GDX, GDXJ, and GLD. Refined Investors familiar with our core strategies understand that the MA Envelopes trade is one of the most powerful intermediate-term buy signals that we have…

…not only were the MA Envelopes crossed, but we had the highest volume ever in GDX. GDXJ set all-time price lows, and was down a capitulation-worthy 12 days in a row. GLD saw an impressive 30.9 million shares change hands, and even though that pales in comparison to volumes over the last 5 years, it represents a strong pulse in a market considered by many to be dead money since the September 2011 highs. Sentiment in the sector is currently sitting at multiyear lows, and with a COT report showing hot money flipping strongly to the short side in gold after remaining stubbornly long, we now have all of the elements necessary to form the 4-year cycle low.

In the bigger picture, GLD has now been consolidating for 17 months and SLV for a mind-numbing 22 months since their respective highs. This compares in number of months to previous consolidations within the bull market, although with the larger percentage gains out of the 2008 lows it is not unreasonable to expect that this consolidation will be the longest yet. Like any market that sees a dramatic rise in prices, the precious metals have seen a lot of raw supply pour onto the market, particularly in silver. The number of “We Buy Gold” stores has grown exponentially, and cash-strapped retail customers have sent many old silverware sets and necklaces to the refiners in exchange for cash over the past two years. Working through this supply doesn’t happen overnight, but it appears the slack in the precious metals market is finally starting to tighten up as investors become comfortable with current prices.

Technically, a common movement we see at the end of a consolidation is what I call “The Golf Cart Juke”. The goal of the markets is to keep the fewest number of participants along for the ride, and it does this by using price inertia to take you out of your position. If you were driving forward in a golf cart with a friend (they must be a really good friend) and you wanted to eject them from the cart, how would you go about it? Even by turning the cart sharply to the left you give them time to grab a handle and hold on for the ride (albeit with a nasty look). No, the way to eject someone from a golf cart is to first make a steady move in the direction that you want them to go, and then quickly spin the wheel in the other direction. By doing this, you have forced their inertia away from the cart, and if you do it subtly enough they will not have grabbed a handle before you make the hard turn, and they are thus ejected from the cart.

I believe that the precious metals sector has just given us the “Golf Cart Juke”, but because momentum is still strongly down we didn’t have a valid trade until the MA Envelopes were crossed and a mean-reversion signal was generated. Preliminarily, our target is the 50 MA on the way to a possible multiyear climb as we move out of this potential 4-year cycle low. The trading is expected be choppy as bold shorts take more shots at the downward sloping short-term MA’s, but that will only add more fuel to the fire on the long side. As always, we must practice proper risk management if they temporarily succeed and price approaches the Feb. 20th lows. However, nothing has been resolved fundamentally in the markets to destroy the bull case for precious metals, and the opportunity to buy a maturing bull market at multiyear lows in price and sentiment should have our mouths watering, not screaming in fear. We will exit our trades if new price lows are made, or reexamine them upon reaching the downward sloping 50 MA.

Good trading all.

Steve Chapman, TRI

We finally saw some big moves in the markets after many weeks of complacency to start 2013. The most notable knee-jerk price moves were in the panic buttons – the $VIX, currencies, and treasuries, with equities and precious metals once again going in opposite directions…

…if you haven’t heard it before, markets top on complacency and euphoria and they bottom on pessimism and fear. As Refined Investors, we want to take the contrarian trade, but we don’t want to be contrarian just to be contrarian and go against momentum, the market must give us an entry that T.E.M.P.O.S. can support. There is extreme risk in equities right now as they once again approach cyclical highs, and while we have the expectations for a new high to be made in the $SPX, at the start of today that was less than 4% away. Not a great risk/reward scenario with central banks engaged in currency manipulation and deteriorating economic fundamentals under the hood. An index as large as the $SPX doesn’t top overnight, as it represents the passive portfolios of millions of Americans amongst many others, but a flood usually begins with a crack in the dam. Typically, we will get 1-2 more failed attempts at new cycle highs over a multiweek period before an ideal shorting opportunity presents itself at the end of a cycle. However, with $85 billion a month being injected into the bloodstream of the market, shorting equities is not the best intermediate term opportunity here. A long entry after a multiweek cycle low has a better chance of being successful. Those that would like an opportunity to put on a short position should wait until the $SPX retests the highs with a close stop.

So, at this point, where is the best place to put our money to work over the intermediate term? On the long side, we always look to the T.E.M.P.O.S system to see what entries are shaping up in the market. The most hated ETF’s right now sentiment-wise are precious metals and miners, and for good reason – they have drastically underperformed equities as fear has been wrung out of the market. Last week, GLD/GDX/GDXJ generated MA Envelope mean reversion signals on massive volume, and that is a low-risk trade that we have to take with a stop under the now confirmed swing low. Although momentum is strongly down for the precious metals, with silver still more indecisive than gold, we would rather be buying an instrument at multiyear lows in price and sentiment, with a strong fundamental backdrop, than an instrument just under highs that have been resistance for over a decade. This precious metals trade was not viable until the MA Envelopes signal triggered, and now that it has we are starting to see a move upwards.

We must continue to watch the metals and miners, because price action will be choppy as they navigate through the plummeting 9 EMA and 20 MA on their way to our target of the 50 MA. We can’t rule out the possibility of a lower low as emboldened shorts and scared longs adjust their positions, until price becomes supported by the 20 MA, and the 50 MA begins to flatten out. We will need to practice proper risk management on our positions by stopping out under the recent swing low if necessary. Another opportunity will present itself in that scenario at the next cycle low with the MA’s beginning to flatten out and/or the MA Envelopes being crossed again.

- Equities – watching to see if the next bounce makes a higher high, due for an upcoming cycle low

- Volatility – if equities are due for a cycle low, XIV should begin to move down in tandem over the upcoming weeks

- Dollar – late in the daily cycle, forming as extremely right-translated, a higher high is expected after the next cycle low

- Precious Metals – mean reversion trade triggered last week in oversold conditions, continue to hold as volatility returns to the market, stop under the recent swing low

Good trading all.

Steve Chapman, TRI