To a passive investor, the Dow Jones Industrial Average is sitting at all-time highs and the future is bright. To a casual investor, the cyclical move out of the 2009 lows has been impressive but there are a few red flags starting to emerge. To a professional investor, there is an epic battle being waged that only occurs a handful of times every 15-20 years. What I mean by that statement is that we are on the cusp of a potential transition. This transition is not necessarily going to happen, but from a risk management perspective we have to have a plan for it…

The $SPX is trying to prove that it is transitioning from a cyclical bull market to a secular bull market, and by doing so it will dethrone gold as the current title holder of “asset class of choice”. Just like a boxer fighting his way to the top to get his chance at the world champion, so too are stocks trying to deliver that knockout punch to precious metals. Gold has remained the favorite for the last 12 rounds of this match of unknown length, but in the 13th round it is stumbling and disoriented, and so too are its fans. Sentiment has never been worse, never has it had 5 consecutive negative monthly closes in a row, and downside targets have never been lower. Will gold have its Rocky Balboa moment and come back to life with a miraculous burst of energy with greater glory in years to come? Or will it just be a barbarous relic liquidated regretfully at the local “We Buy Gold” store by those that have loved it for so many years?

At the moment, nobody knows that answer. Our job as Refined Investors is not to predict the future, but instead to own the asset classes with significant potential for appreciation and a practical plan for risk management. We want to own assets with a solid fundamental backdrop, in a secular bull market, at times when they are unloved and undervalued by other participants. The biggest positive of investing in a secular bull market is that surprises happen to the upside over the longer-term, and investing mistakes can be remedied. Every other investment is simply a chase of short-term money flows, and mistakes have very little chance for recovery once the hot money rotates somewhere else.

Therefore, as Refined Investors where should we be allocating our investment capital, and how should we protect it? We can’t buy an asset simply because it is unloved, oversold, and with momentum against it, because these “value traps” can occur for years. We either want to buy notable momentum crosses such as our 9 EMA/20 MA cross, cycle lows within momentum trends, or mean reversion opportunities when trends are taken too far. Randomly buying a low just because of a date, swing low, sentiment number, media story, chart pattern, or technical indicator, especially with momentum against us, is a surefire way to chop up our account.

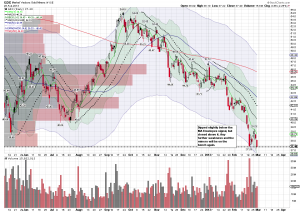

First off, the market took price lower in GDX, and because of our risk management we were forced to remove the position from our portfolios. Even though every contrarian buy signal in the world is flashing brightly, we have to respect the price action. We will continue to monitor the miners going forward and be ready for an entry, especially on an additional breach of the MA Envelopes. With that being said, let’s survey the landscape and see if the market is presenting any opportunities for our capital:

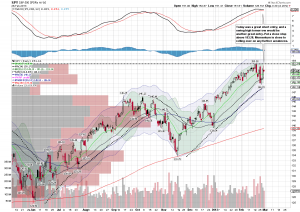

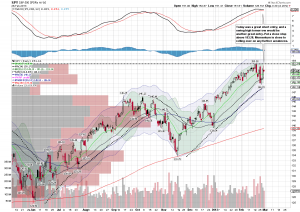

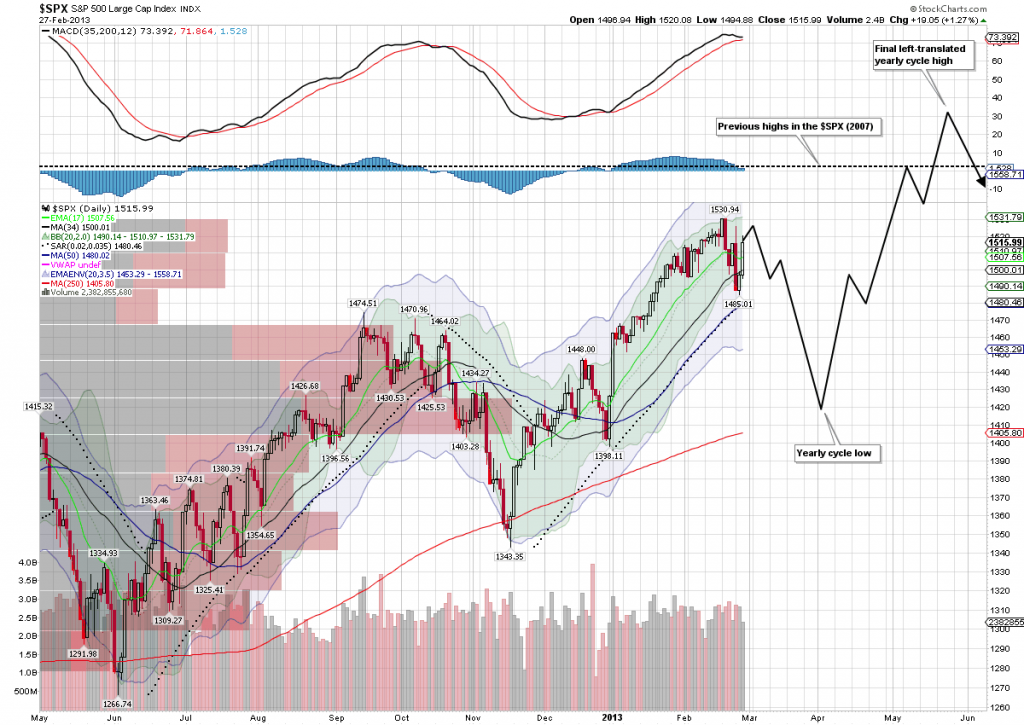

SPY

XIV

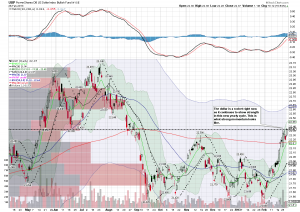

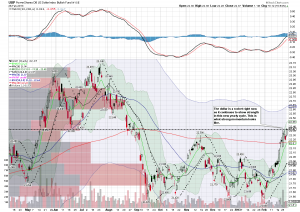

UUP

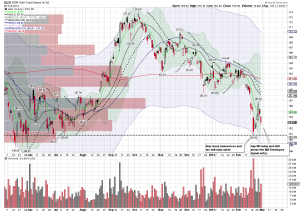

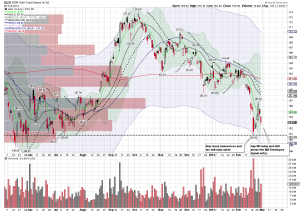

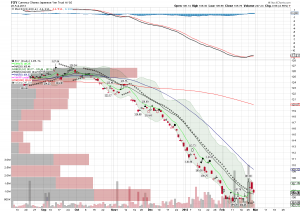

GLD

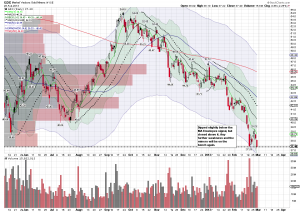

GDX

IBB

We have been patiently waiting for the market to make its next move, specifically in SPY, UUP, and GLD/GDX. We will continue to watch SPY to see if new highs are made, GLD to see whether new lows are made, and UUP to see if it moves into a daily cyle low. However, IBB also has a tremendous chart setup with an ideal risk/reward entry, and a long position with a stop under Friday’s low is appropriate.

Focus on your risk management and continue the search for ideal entries with close stops and favorable momentum or mean-reversion characteristics. This late in a boxing match, it all comes down to preparation and mental fortitude. It will be exciting to see which market prevails. Enjoy your weekend.

Good trading all.

Steve Chapman, TRI

Our ideal framework continues to unfold in a positive manner, as gold and silver futures were pushed down in early trading this morning but exploded out of their 8 AM London Fix with silver popping over 2%…

…I can not stress enough the point that when risk seems the greatest it is actually the lowest, and vice-versa. We have a close stop on our GLD MA Envelopes trade, our GDX MA Envelopes trade, and our SPY short. As a Refined Investor, that high risk/reward scenario is the best setup you can hope for. Waiting for the market to put one on a tee for you requires significant patience and usually involves more time being out of the market than in the market.

We will continue to let these positions develop over the next few weeks, and if we are wrong then our risk management will take us out of the game. My outlook is that we will continue to see the inverse correlation between the $SPX and precious metals occur, just in the opposite direction in the near-term. That would allow our MA Envelopes mean reversion trades to get back to their 50 MA target, and then we would be hunting for an XIV entry at the next $SPX cycle low.

As always, one step at a time with good risk management.

Good trading all.

Steve Chapman, TRI

I apologize for the late post as I was celebrating a birthday today with family. While the developments in the market were not ideal, they still fit completely within our current framework. As always, proper risk management is the most important thing, and despite some divergences today, if the dollar continues to show strength relative to other currencies…

…we will have to step to the side and wait for a new entry. Our long positions in metals and miners are back to square one, and we knew that going against the momentum was bound to be choppy. The retest today was on much lighter volume than Feb. 20th, but that is no guarantee that the move down is over. Miners actually dipped slightly below their lows but managed to end the day above them. Any further weakness tomorrow and they will be removed from our portfolio until another high risk/reward setup is presented. GLD was not as weak, but still could not stay above its 9 EMA over the last two days.

The SPY gave us our desired short entry today as it approached the previous highs and faded into the close. A short position with a stop above the 153.28 high is a great risk/reward entry as we watch for momentum to roll over. A swing high tomorrow would be further confirmation of a move down into a cycle low, but we have to be prepared for one more attempt at the highs if we are still in the previous aging daily cycle.

Here are the charts from today:

SPY

UUP

XIV

GLD

GDX

To summarize, our gameplan for tomorrow is:

- Stop out of GDX upon further weakness

- Stop out of GLD if price moves under the Feb. 20th lows

- Watch our SPY short for a swing high as further confirmation of a move into the daily cycle low

- Watch XIV for confirmation of a move down in equities

One thing to keep an eye out for are the beautiful pullbacks and MACD crosses in the $VIX, FXY, and TLT after their big pops Monday. With the sequester in play tomorrow, this would be a great time for the $SPX to move down into a daily cycle low:

$VIX

FXY

TLT

I apologize for the shorter than usual post tonight, but my family has made a delightful dinner and I have some angel food cake and strawberries to make disappear.

Good trading all.

Steve Chapman, TRI

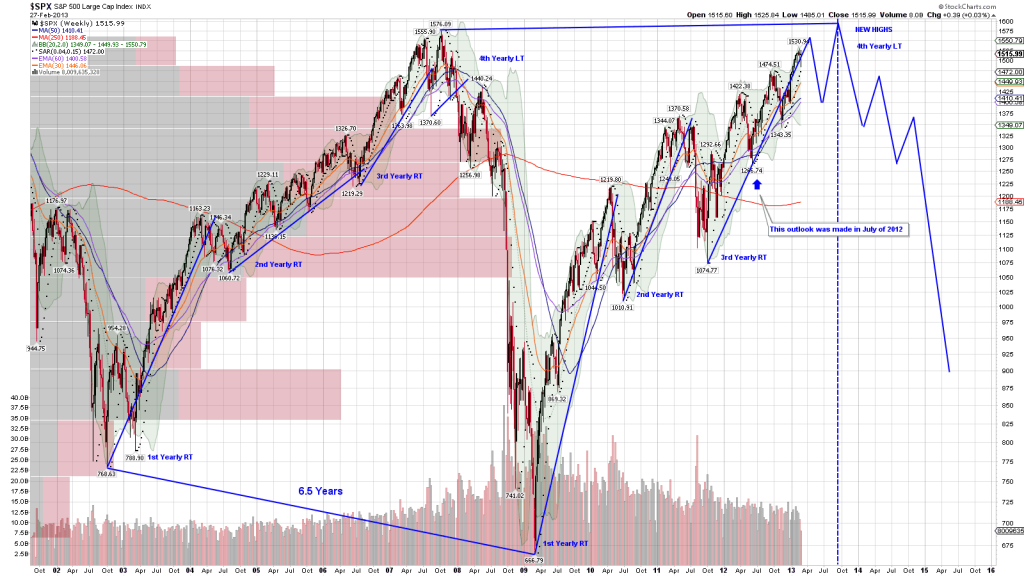

While we wait patiently for the market to make its next move according to our framework, I want to step back a little bit and zoom out on the big picture. A lot of times we get so caught up in the daily wiggles that we forget about what is happening on the weekly, monthly, and yearly time frames. Here is an outlook for the $SPX that I published in July of 2012, and while it was just a guess based on past cycles, it is remarkable how the pattern continues to repeat in a logical way…

Because of central bank intervention and zero interest rate policies, the typical 4-year market cycle has been stretched significantly as big businesses are no longer allowed to fail. To understand a typical market cycle, it begins with healthy banks lending money to businesses. These businesses take the money and build things and hire people. As more orders come in, the businesses expand and hire more people and borrow more money to meet demand. After a certain point, the businesses that have made a good product and managed their balance sheets intelligently have a healthy, profitable company, while their competitors that either have an inferior product, bad leadership, or too much debt are struggling to survive. At this point, a cleansing process happens, and some companies file for bankruptcy protection, some are forced to sell assets at a discount, and many people are laid off.

This cleansing process also happens in nature, and despite the temporary pain, it is healthy and allows more growth to eventually occur. For example, a forest begins with young healthy trees, and after enough time the trees grow and mature. At a certain point, some of the weaker trees begin to die, their branches litter the ground, and the forest no longer provides a hospitable environment for the smaller plants and animals. However, nature has a solution. When lightning strikes the trees a forest fire is started, and as the old trees and branches are swept away in flames, an ideal environment for new growth is created. This is supposed to happen in the financial markets as well.

With politicians fearful of suffering a market decline during their terms, the printing presses are working overtime and we no longer have our “lightning strike” moment in the economy. Only the strongest trees are allowed to survive, and all of the time and money is spent on sustaining them. The environment for the rest of the plants and animals continues to worsen, and new growth is never allowed to occur. The longer that this approach is taken, the larger and more dangerous the forest fire will be when lightning eventually does strike because of the massive amounts of dead, dry wood piled up beneath the big trees.

Overly-detailed metaphor aside, we are at a similar inflection point in the market. The $SPX is within a few percentage points of decade-long highs, and I am a firm believer that the algos are salivating (condensating?) at the opportunity to run price up to new highs and hand the bag to retail investors that will be seeing “new highs” proclaimed from every media outlet in the world. The stubborn shorts at that point will be completely decimated and finally capitulate to the long side. Markets make cyclical highs on complete euphoria, not cowering in fear. However, to accomplish this task I think they are first going to need the energy from a new yearly cycle:

We know that after a right-translated cycle, the next cycle typically forms a new high, even if it is left-translated. This current yearly cycle in the $SPX is extremely right-translated, and therefore the upcoming yearly cycle low should be very mild. For the cyclical bull move out of 2009 to finally end, it has to form a left-translated yearly cycle and eventually move into its 4-year cycle low (which has been stretched to +/- 6.5 years). What we want to see happen eventually is a lower high formed, similar to the right shoulder of a head and shoulders pattern, with the longer term weekly and monthly moving averages rolling over. It is after that point that we should be short the market, but until then it is very dangerous because of the printing press:

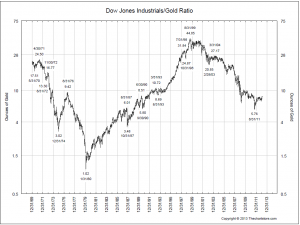

It should be at this short entry point in equities that precious metals are breaking to new highs and well into their final parabolic move. A partial collapse of the current worldwide financial structure and a return to the Dow:Gold ratio of 1:1 (that peaked at 44:1 in 1999) should be the target as lightning finally strikes the bond and derivative markets and the cleansing process begins. A healthy position in both trades will be ideal as we don’t know how they will change the rules at that point to protect the system.

Although that scenario sounds extremely gloomy, this will not be the first time in history that it has happened, and it will not be the end of the world. Lightning struck in 1979 and it spawned one of the greatest secular bull markets in recent history, ending with the Dot-Com mania in 1999:

So as we wait patiently this week for the market to make its move, let’s keep the big picture in the back of our minds and not get too caught up in the daily wiggles. There is abundant opportunity ahead for the Refined Investors.

Good trading all.

Steve Chapman, TRI